- Related articles

- Optical Transceivers for Cisco WS-C3750V2-24PS-E Switch

- Optical Transceivers for Cisco WS-C3750G-12S-SD Switch

- Optical Transceivers for Cisco SG500-28MPP-K9-G5 Switch

- Optical Transceivers for Cisco ME-3400-24TS-A Switch

- Optical Transceivers for Cisco WS-C2960+24LC-L Switch

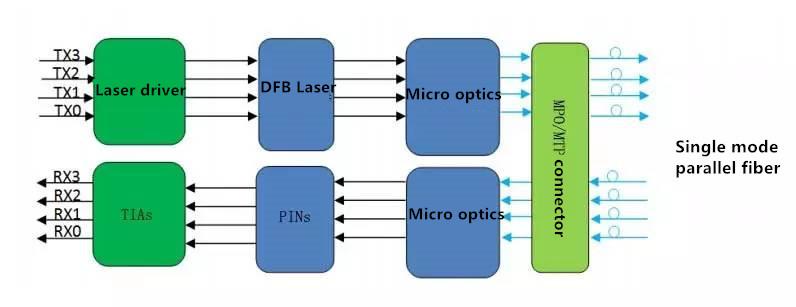

- Applicable to 40GBASE-PLR4 Standard Optical Transceiver Models

- The Difference between SFP+ and X2

- Easiest Way to Know the History of Fiber Optic Cable

- How to troubleshoot when network card stops working?

- Optical Transceivers for Cisco N9K-C9336PQ= Switch

Active Optical Cable Market Overview:

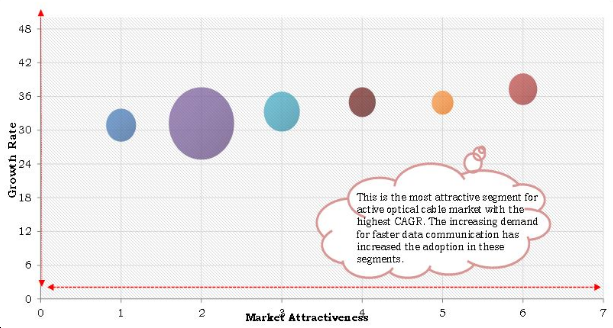

Global active optical cable market was valued at $481.3 million in 2015, and is expected to reach $3,480.7 million by 2022, supported by a CAGR of 32.7% during the forecast period 2016 to 2022.

The global active optical cable market is primarily driven by a growth in the demand for active optical cables in data centers and an increase in the demand of high bandwidth networks. Cloud based applications; audio and video services, online gaming, and CATV require high-speed data services, which are facilitated by the use of AOCs. However, the high initial investment and the threat of replacement from copper cables and wireless broadband limits the growth of this market. The advancement in the fiber optics technology provides numerous opportunities in this market.

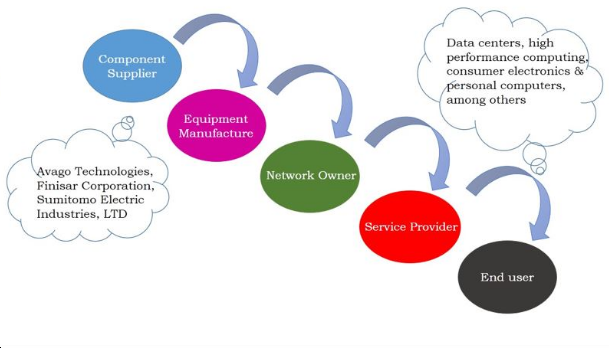

The active optical cable market is concentrated; the top five leading players including Finisar Corporation, Avago technologies, Oclaro, Inc., Viavi Solutions Inc. and Sumitomo Electric Industries, Ltd. occupy around 65% of the overall AOC market. The AOC market is currently dominated by Finisar Corporation. The company has focused on the datacom sector; and a large part of its sales came from this sector in 2015. However, other players such as Avago technologies and Oclaro, Inc. are expected to give a tough competition to Finisar in the future. The primary factors that enable companies to strengthen their market position through strategic moves are product launches, partnerships, agreements, company acquisitions, and geographic expansions.

Segment review

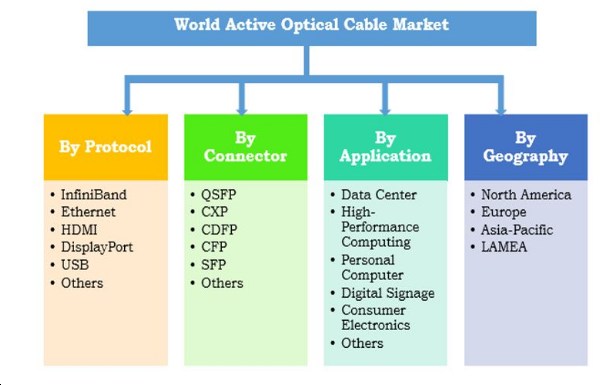

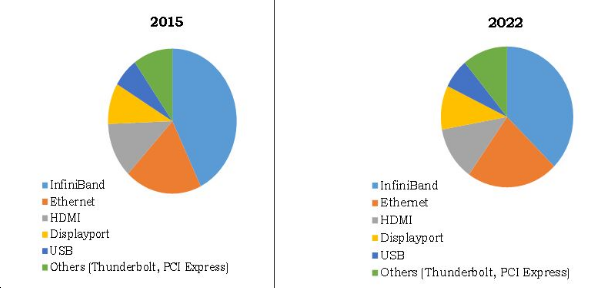

The active optical cable market is segmented on the basis of protocol, connector, application, and geography. The protocol segment is further categorized into InfiniBand, Ethernet, HDMI, DisplayPort, USB, and others (Thunderbolt and PCI Express). Currently, the InfiniBand segment holds a significant share in the overall market, due to its increased usage in commercial applications such as data centers and high-performance computing. The connector segment is divided into QSFP, CXP, CDFP, CFP, SFP, and others (CX4 and mixed connectors). Among the connector segment, QSFP and CXP accounted for the maximum share in 2015. The application segment includes data center, high-performance computing, personal computer, digital signage, consumer electronics, and others (transport, telecom cable, medical, airport, aircrafts, and ships). In the year 2015, data centers contributed the highest revenue share, accounting for around 50% of the overall market revenue. Based on geography, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA. In addition, the report covers country-wise cross-sectional analysis of the protocol, connector, and application segments.

Active Optical Cable Value Chain Analysis

Global Active Optical Cable Market Scenario

KEY BENEFITS

ACTIVE OPTICAL CABLE MARKET SEGMENTATION

- InfiniBand

- Ethernet

- HDMI

- DisplayPort

- USB

- Others (Thunderbolt and PCI Express)

- QSFP

- CXP

- CDFP

- CFP

- SFP

- Others (CX4 and Mixed Connectors)

- Data Center

- High-Performance Computing

- Personal Computer

- Digital Signage

- Consumer Electronics

- Others (Transport, Telecom Cable, Medical, Airport, Aircrafts, and Ships)

- U.S.

- Mexico

- Canada

- UK

- Germany

- Russia

- Netherlands

- France

- Rest of Europe

- China

- India

- Japan

- Australia

- Singapore

- Rest of Asia-Pacific

- Latin America

- Middle East

- Africa