- Related articles

- Optical Transceivers for Cisco WS-C3560G-48PS-E Switch

- Optical Transceivers for Cisco WS-C2960-48PST-S Switch

- What Is Pipeline Fiber Optic Cable?

- Optical Transceivers for Cisco SG350-10P-K9-EU Switch

- Optical Transceivers for Cisco ME-3400EG-12CS-M= Switch

- Optical Transceivers for Cisco WS-C2960X-24PS-L Switch

- What is Mini GBIC?

- How to choose the fastest network card for Intel chipset server adapter?

- Optical Transceivers for Cisco IE-2000-4TS-G-B Switch

- Optical Transceivers for Cisco SG300-28MP-K9-UK Switch

According to a report named “Optical Network Hardware Tracker” provided by IHS, a research company, the year of 2022 is a year of harvest to many vendors in optical communication industry. Driven by the whole industry, optical interconnection hardware market increased in 2022, although it has the most fierce competition. However, will this tendency be kept in 2023 for optical interconnection hardware market? Insight of 2023 optical interconnection market will be offered in this article.

Where There Is Need There Is Market

In the past year, the growth of optical interconnection is largely driven by the increasing needs for higher Ethernet speed. Behind these needs are the widespread of advanced technologies and applications like Cloud, Internet of Things and virtual data center. The wide deployment of FTTx and 4G network are also great drivers of optical interconnection market increasing. In 2023, the applications of the advanced technology and deployment of fiber optic network will obviously still be biggest driver of the optical interconnection hardware market. The main characteristics of 2023 optical interconnection hardware market can be concluded by the three keywords: high speed, compatible and high density.

High Speed

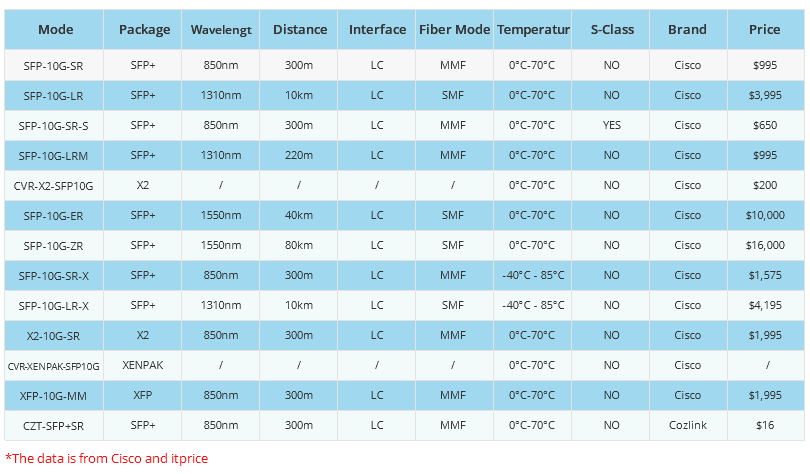

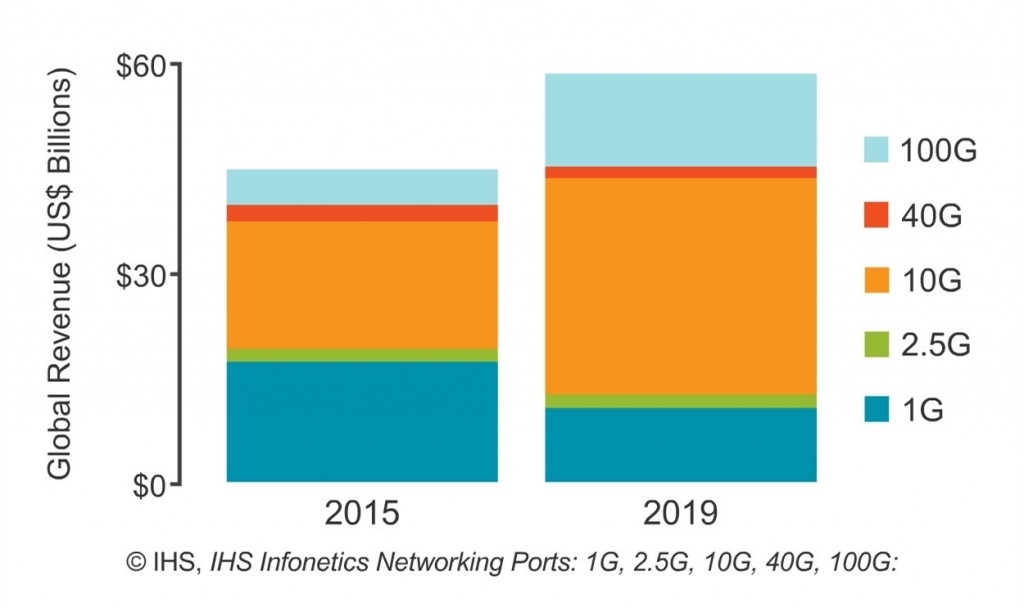

It has been clearly proved in the past years that only higher speed Ethernet like 40G or 100G can keep up with the growing needs. Some large data centers have already switched to 40G and 100G in the past years, although it has not yet been widely applied. However, according to research by IHS, 40G and 100G will be the key growth segment of the market in the coming years, and 2023 might be the breakout year of 100G technologies. The following picture shows the prediction of global revenue from 2022 to 2028. The 100G market is supposed to grow 262 percent from 2022 to 2028. For optical interconnection hardware market, sales of 100G hardware market will also increase largely. Cozlink leading providers in optical communication has already launched 100G interconnection products, like 100G transceivers and DAC (direct attach cable).

Compatible

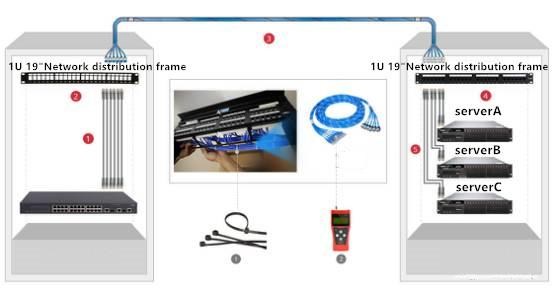

High Density

Where There Is Market There Is Competition

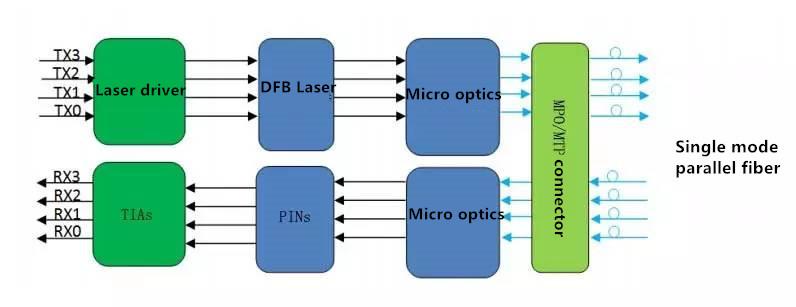

What is Optical Interconnection?

Future Challenges

Future Directions

What is the market size of optical interconnect?

The Optical Interconnect Market size is estimated at USD 15.15 billion in 2023, and is expected to reach USD 28.10 billion by 2028, growing at a CAGR of 13.15% during the forecast period (2023-2028).

North America To Witness High Market Growth

-

The rapid penetration of the internet is expected to raise the growth of the market in this region. Moreover, according to Cisco Systems, the cloud traffic in 2021 is estimated to be around 6844 exabytes per year in North America, which is highest in comparison to other regions. According to the November 2020 edition of the Ericsson Mobility Report, North America was expected to end 2020 with about 4% of its mobile subscriptions being 5G. Hence, such trends create scope for the market, as a powerful interconnect is required to enable cell towers and other applications to handle 5G transmissions.

-

Also, North America has various players that provide optical interconnect products and solutions, along with players who are also keen to innovate new solutions for the improvement in interconnect bandwidth density at around 10x lower power. For instance, in March 2020, Ayar Labs announced that it had received a strategic investment from Lockheed Martin Ventures, where the funds will be used to accelerate the commercialization of Ayar Labs’ patented monolithic in-package optical I/O (MIPO) solution for applications that require high bandwidth, low latency, and power-efficient short-reach interconnects.

-

Moreover, data movement within the data center is becoming a critical feature, and the rise in the ample of new businesses leveraging data center services in the United States, and Canada will leverage more machine-to-machine (M2M) traffic. To overcome this problem, IBM focuses on providing optical switches in the data center as a key to resolve the problem. IBM is undertaking to build reconfigurable optical switches using silicon-photonic technology. If implemented, this optical solution becomes a new trend in the optical interconnect market.

-

In June 2020, Equinix Inc., the global interconnection and data center company, announced its agreement to purchase a portfolio of 13 data centers across Canada from BCE Inc for USD 750 million in an all-cash transaction. The 13 data center sites representing 25 Bell data center facilities are likely to generate approximately USD 105 million annualized revenue.

Related Reports:

The optical switches marketis estimated to grow at a CAGR of 11.38% between 2022 and 2027. The size of the market is forecasted to increase by USD 4,896.63 million. This report extensively covers market segmentation by application (data communications, telecommunications, and others), type (large enterprise and SMEs), and geography (APAC, North America, Europe, Middle Eastand Africa, and South America).

The passive optical LAN marketsize is expected to increase by USD 21.85 billionfrom 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 17.10%. This report extensively covers passive optical LAN market segmentation by component (optical line terminal, optical splitter, and optical network terminals) and geography (APAC, North America, Europe, South America, and MEA).